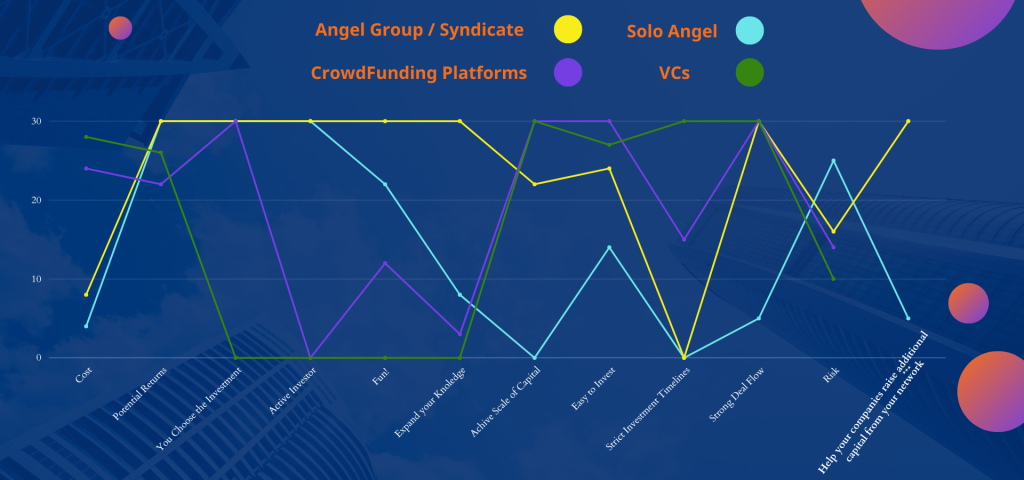

Having launched the first Tech Angel Club in Greece and after 6 months in operation, we have created a chart comparing various alternatives for individual investors and their (in)direct competition. By analysing this chart, we see four main ways for an individual investor to invest in startups:

- As a solo angel

- As part of an Angel Club (like Theti Club)

- Via an Equity Crowdfunding Platform

- Indirectly, as an LP in a VC

Some advantages may be disadvantages for some investors and vice versa, depending on their profiles. We primarily consider VCs from an individual investor’s perspective here, not as institutions.

Solo Angel Investing

Solo Angel Investing offers low costs and the potential for high returns, though it’s risky to go at it alone. Investors get to participate in investments actively, making the process hands-on and fun. They choose which startups to invest in and operate without strict timelines. However, creating a high-quality, consistent deal flow takes work.

There’s no bargaining power, and it’s hard to reach safe conclusions by analysing the business alone. Closing a funding round by oneself is complex, often leaving the company unable to raise the remaining capital, heightening the risk. Additionally, investors have to do all the work involved in investing. This approach is ideal for investors who have discovered a market opportunity and want to exploit it without building a portfolio.

Angel Club (such as The Hellenic Tech Investor Club)

Being part of an Angel Club like Theti Club is low-cost, with the potential for high returns. The club provides a steady and high-quality deal flow, allowing for active investment participation. Members are part of an exclusive peer group with other sophisticated investors. The club’s mastermind group discusses and analyses investment opportunities, reaching safer conclusions and decisions.

Members have fun participating in investors’ meetings while achieving the scale of capital by co-investing with other angels and operating independently without strict investment timelines. Meanwhile, they can bring their other investments and help them raise capital, lowering their risk —a value proposition that might not be clear from the start.

However, it’s not the easiest way to invest, though it’s simpler than going solo and more complicated than using Equity Platforms or being an LP in a VC. The decision-making still rests on the individual, who may not be a professional. Not all group investors will want to support every business opportunity and to become a member, one needs to be a successful entrepreneur or a C-level executive with a strong business background. This option is for seasoned professionals (entrepreneurs or C-level executives) who want to build a portfolio and invest consistently. They have the skills to understand and analyse investments and want to be active investors, providing money and expertise.

Equity Crowdfunding Platforms

Equity Crowdfunding Platforms offer the potential for high returns — typically better than amateur solo angels but lower than experienced angels in groups or VCs. These platforms are ideal for inexperienced investors with limited budgets. Most of the time, investment rounds will close, de-risking the investment to a degree. The deal flow is steady, and the investment process is straightforward.

However, the costs are relatively high and sometimes hidden. Investors never meet the founders in person, which is a significant downside, as angel investing is all about the people. There is no participation in the business’s success, and the platforms must improve investment reasoning. Investment decisions rely solely on information companies provide, which they polish to sell investments. Equity Crowdfunding Platforms are perfect for individuals with a small investment budget and limited experience, offering a straightforward investment method.

LP in a Venture Capital Firm

Being an LP in a Venture Capital Firm means professionals do all the work. There’s potential for high returns and good diversification across various deals.

The downsides are significant, though. The costs are high, and there’s a lack of involvement in day-to-day operations—which can be an advantage for passive investors but not for the typical angel investor. There’s no control over where and how your capital is deployed. The experience is transactional—no fun—and you can’t help the company by providing extra value as a hands-on investor. The investment periods are long. Being an LP in a VC is ideal for those who lack the time or the knowledge to be angels—it’s hassle-free, with professionals doing all the work.