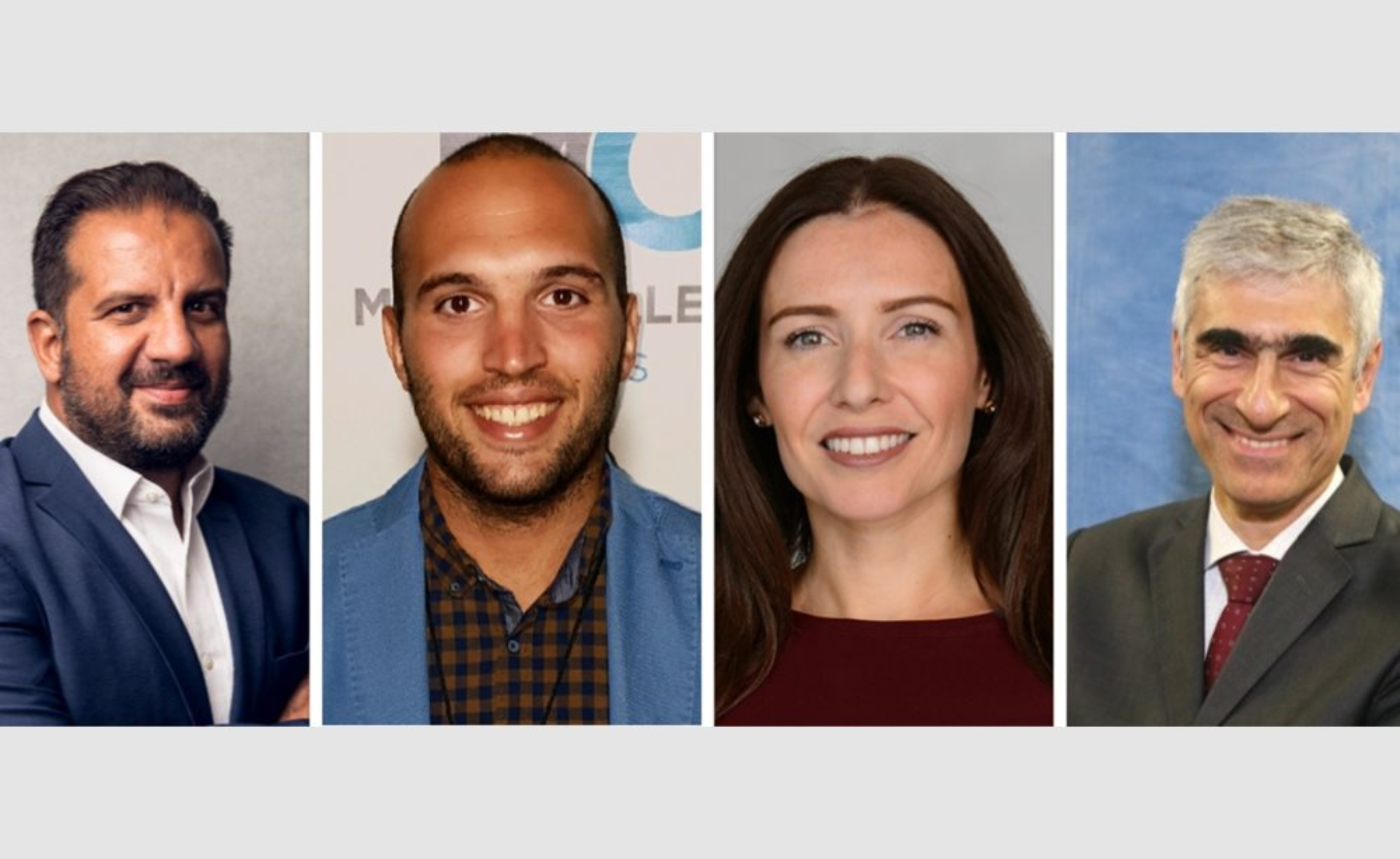

Recently, four of our distinguished members—Giorgos Varvarelis (Founder, Augmenta), Chrysanthi Vakla (Partner & Deputy CEO, Susten), Argyris Kaninis (Co-founder, Softomotive), and Giorgos Katiniotis (CEO, Acromove)—shared their insights with Capital.gr on why and where they invest, as well as the challenges and opportunities they see in the Greek tech landscape.

Why They Became Angel Investors

Each investor has a unique reason for entering the world of angel investing.

- Giorgos Varvarelis emphasized his desire to give back to the startup ecosystem that once supported him. He believes that fostering entrepreneurship in Greece is key to building a strong tech hub.

- Chrysanthi Vakla highlighted how angel investing was an exciting departure from corporate predictability, offering her a chance to be part of the vibrant, fast-moving startup world.

- Argyris Kaninis pointed to his own entrepreneurial journey with Softomotive, stressing the importance of mentorship and guidance in the early stages of a startup’s life.

- Giorgos Katiniotis underscored the need for Greek startups to focus on creating high-value technology while retaining intellectual property within Greece.

What They Look for in Startups

During the discussion, these experienced investors provided key insights for founders seeking angel investment:

- Strategic investors matter – It’s not just about the money; the right investor can offer invaluable experience, connections, and guidance.

- Solve real problems – Investors prefer “painkillers” over “vitamins”—startups that address urgent, clearly defined needs rather than just improving convenience.

- Think beyond Greece – While supporting local innovation is crucial, successful Greek startups must have a global mindset from day one.

Challenges and the Future of Angel Investing in Greece

While the Greek startup ecosystem has grown significantly, challenges remain. Bureaucracy, access to large VC funds, and a culture that is still evolving toward risk-taking are some of the hurdles. However, initiatives like Theti Club are helping build a stronger investment community, creating opportunities for founders and investors alike.

These insights reaffirm the importance of angel investors in driving Greece’s startup scene forward. With the expertise and commitment of our members, Theti Club continues to foster innovation, providing startups with both capital and the strategic support they need to thrive.

Read the full article here.